Our Financial Life Planning Process

First Things First

Let’s talk. We can meet in person, on the phone or a video call. We would like to take some time to get to know you. There is no need to prepare anything beforehand. We just want to understand what brings joy to your life and gives you purpose. You have dreams, some realistic and some that are very ambitious. We want to hear it all! No dream is too big when you have a team of people who understand your goals and can help you take realistic steps to making the things that are important to you happen. We approach financial planning with an inventive and grounded approach so that giving up on your dreams never seems like the best solution.

Our process helps families and business owners to experience the following:

- Simplified finances through the development of investment and savings plans

- Developing tax reduction strategies and asset protection through benefit plans, insurance solutions and buy-sell agreements

- Removing apprehension about the future through services such as long-term care, generational planning and medical and estate needs

- Peace of mind for education planning including 529 Plans and Tax-deferred savings

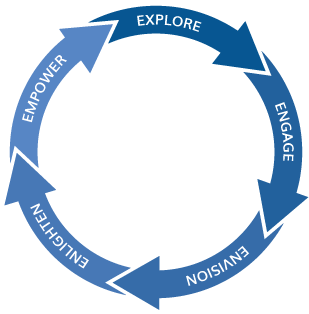

There are five stages to the Financial Life Planning process®.

The following outlines the objectives of each stage and the role of your financial advisor.

Explore:

- Get Acquainted

- Learn about Your Needs, Concerns, and Aspirations

- Provide Information/Describe Process

- Relate Services to Your Issues

- Determine Fit and Establish Relationship

Engage:

- Gain Awareness Regarding Your Unique Frame of Reference

- Listen to Your Perspective

- Identify Your True Values

- Clarify Your Priorities

Envision:

- Guide You in Creating a Vision of Your Ideal Life

- Help You to Define and Prioritize Your Personal and Financial Goals

- Establish Guidelines for Developing a Financial Plan that Aligns with Your Values and Priorities

Enlighten:

- Summarize and Clarify Insights and Knowledge about Your Values, Priorities, Concerns, Transitions, Goals, and Objectives

- Demonstrate How the Financial Solutions Proposed Support Your Life Vision and Goals

Empower:

- Monitor Progress and Help Maintain Focus on Your Personal and Financial Goals

- Review Your Life Goals Periodically to Ensure Your Financial Plan Continues to Support Your Life Vision

- Address New Issues, Transitions, and Concerns